A new federal government program, called Home Affordable Foreclosure Alternatives, encourages lenders to pursue alternatives to foreclosure.

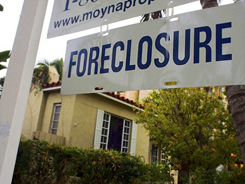

Millions Facing Foreclosure

No homeowner wants to face foreclosure. It can be devastating both personally and financially. If you are faced with foreclosure now, or worried about it for the future, you’re not alone—15 percent of homeowners were either in foreclosure or delinquency during the last three months of 2009. Many homeowners are choosing to simply walk away from their homes and mortgages, but this can damage your credit score for years, making it difficult to get a loan in the future or even secure a job. A new federal government program can help, however. It won’t save your home, but will help you avoid some of the traumas of foreclosure.

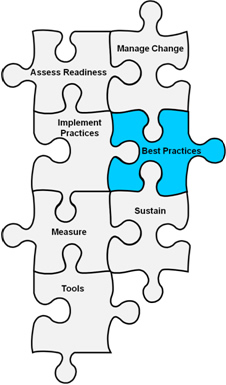

Home Affordable Foreclosure Alternatives Program (HAFA)

Part of the Homeowner Affordability and Stability Plan (HASP), the Home Affordable Foreclosure Alternatives (HAFA) program will launch April 5, 2010. The program provides financial incentives to mortgage lenders to pursue other alternatives to foreclosure, such as a short sale or deed-in-lieu, allowing the homeowner to avoid the substantial costs of foreclosure. There is also a provision for the homeowner to receive up to $1,500 for relocation expenses.

These alternatives reduce the need for potentially lengthy and expensive foreclosure proceedings and generally provide a substantially better outcome than a foreclosure sale for borrowers, lenders and the neighborhood alike.

How HAFA works

- The home must be the homeowner’s principal residence.

- The mortgage must be delinquent, or default must be reasonably foreseeable.

- The unpaid loan balance must be less than $729,750 for a single house or condominium.

- The homeowner’s monthly mortgage payment must be more than 31 percent of gross income.

- The homeowner must transfer clear title. (A clear title is free of liens and legal questions regarding ownership.)

- The homeowner must first be evaluated for participation in a loan modification program prior to entering into the HAFA program.

- The lender may require the homeowner to make full or partial payments on the mortgage, up to 31 percent of the homeowner’s gross income.

- The homeowner can receive $1,500 for relocation expenses at closing. (This sum may be reported to the Internal Revenue Service as income.)

- The homeowner may need to report any forgiven debt as income on their tax return.

- The lender can initiate or continue, but not complete, a foreclosure sale while the homeowner is involved in the program.

- Entering into this program could affect your credit score.

HAFA excludes loans that are owned or guaranteed by Fannie Mae or Freddie Mac. If you are unsure if you have a loan through either of these two government-run mortgage corporations, use the Loan Look Up Tool on the Making Home Affordable Web site.

Talk to a professional

This article contains general information. Individual financial situations are unique; please, consult your financial advisor or tax attorney before utilizing any of the information contained in this article.

Related Articles:

- Should you refinance your home mortgage?

- Loan Modification: Is it Right for You?

- Avoiding Foreclosure Rescue Scams

- How to Improve Your Credit Score

- Does Mortgage Aid Hurt Your Credit?

- How to Improve Your Credit Score

- Does Mortgage Aid Hurt Your Credit?

- What Is A Short Sale?

- What Is A Deed-In-Lieu?

- What Is Foreclosure?

- Do You Qualify for an FHA Loan?

- Protect Your Home's Value From The Foreclosure Next Door

Print

Print Email

Email